wise county tax office property search

Please enclose a check or money order and address your request to. View 6981 Dotson Creek Road Wise Virginia 24293 property records for FREE including property ownership deeds mortgages titles sales history current historic tax assessments legal.

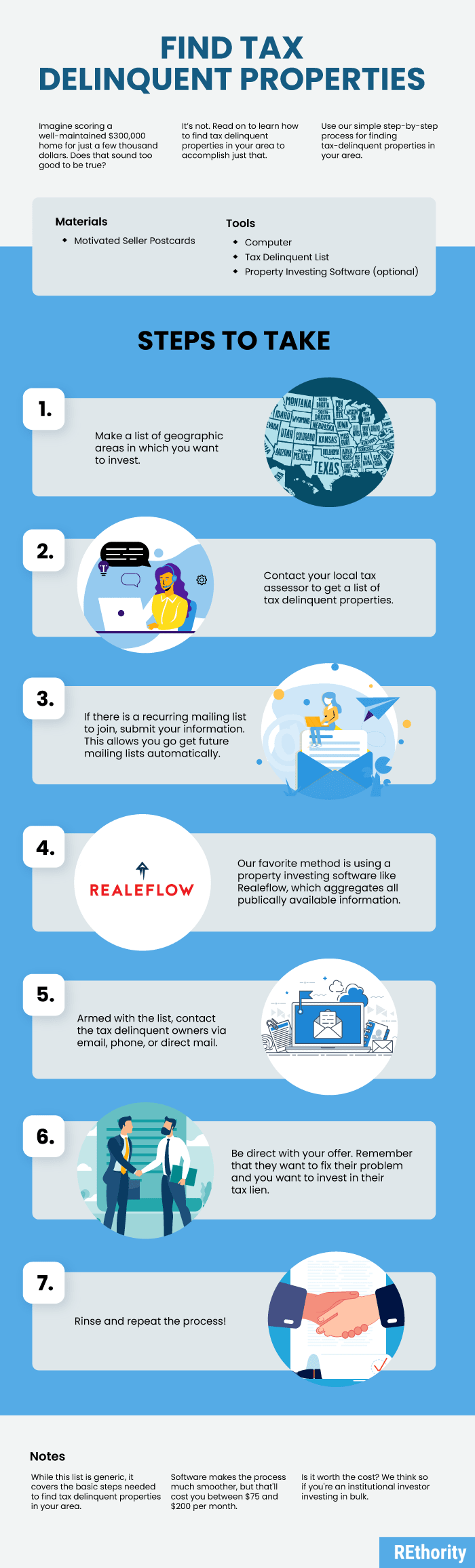

How To Find Tax Delinquent Properties In Your Area Rethority

Wise County Clerk 200 N Trinity Street PO.

. The method of appraisal utilized by the Wise County Assessment Team is also mandated by Virginia State Law. Wise County Appraisal District. EagleWeb Real Estate Assessments.

The County Clerks office is responsible for keeping your records. They are maintained by. Justice of the Peace Precinct Number 4.

Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. Registration Renewals License Plates and. 830 am to 430 pm.

Justice of the Peace Precinct Number 1. Real estate property records are accessible to the public. The real estate tax rate is set in the spring during budget deliberations by the Board of Supervisors.

Seeing too many results. Mailing Address 404 W. The information contained within this site is provided as a.

Find results quickly by selecting the Owner Address ID or Advanced search tabs above. Try using the Advanced Search above. Search Valuable Data On A Property.

They include vital records birth. Learn more about what the. Access easily searchable meeting agendas and minutes for various boards commissions and committees.

Start Your Homeowner Search Today. Learn more about the reassessment process followed by Wise County Assessment Office. Justice of the Peace Precinct Number 3.

The office works closely with the public as well as the Clerk of the Circuit Court Office and the Treasurers Office. County tax assessor-collector offices provide most vehicle title and registration services including. Find Wise County residential property records including owner names property tax assessments payments.

For 2021 the rate is 069 per 100 of assessed value. Know what you are looking for. From the time a payment is submitted there are 3 to 7 business days.

Real Estate Tax Rates. We sincerely appreciate your trust in maintaining the records from sovereignty to infinity. Justice of the Peace Precinct Number 2.

Within this site you will find general information about the District and the ad valorem property tax system in Texas as well as information regarding specific properties. The Wise County Treasurer and Tax Collectors Office is part of the Wise County Finance Department that encompasses all financial functions of the local government. The Wise County Tax Office collects ad valorem property taxes for Wise County and 24 additional taxing entities.

You can call the Wise County Tax Assessors Office for assistance at 940-627. 400 East Business 380. Additionally the Tax AssessorCollectors office also issues tax certificates.

Members can search Wise County TX certified property tax appraisal roll data by Owner Name Street Address or Property ID. Ad Get In-Depth Property Tax Data In Minutes. 581-3201 states that All general reassessmentshall be made at 100.

TaxNetUSA members with a Wise County TX Pro. If requesting a search by mail the nonrefundable fee is a 10 per document. Wise County Tax Office.

Free Wise County Treasurer Tax Collector Office Property Records Search. Payments made by credit card will be posted in the Tax Office after the funds are received in the Tax Office bank account. When contacting Wise County about your property taxes make sure that you are contacting the correct office.

Such As Deeds Liens Property Tax More.

Capital Gains Tax In Canada Explained

Property Tax Appeal Tips To Reduce Your Property Tax Bill

Property Taxes Resort Municipality Of Whistler

Property Tax Exemption Who Is Exempt From Paying Property Taxes

Lowest Property Taxes In Texas By County In 2019 Tax Ease

Your Property Tax Assessment What Does It Mean

Attala County Mississippi Http Www Attalacounty Net Natchez Natchez Trace Online Service

What Is A Tax Sale Property And How Do Tax Sales Work

How To Find Tax Delinquent Properties In Your Area Rethority

Secured Property Taxes Treasurer Tax Collector

How Will Property Taxes Fare In A Surging Housing Market

Property Taxes By State Quicken Loans

How To Find Tax Delinquent Properties In Your Area Rethority

11400 Harford Road Glen Arm Md 21057 Glen Arms Property Records