does maine tax retirement pensions

However you may apply out-of-state government pensions toward the. Web does maine tax pension income.

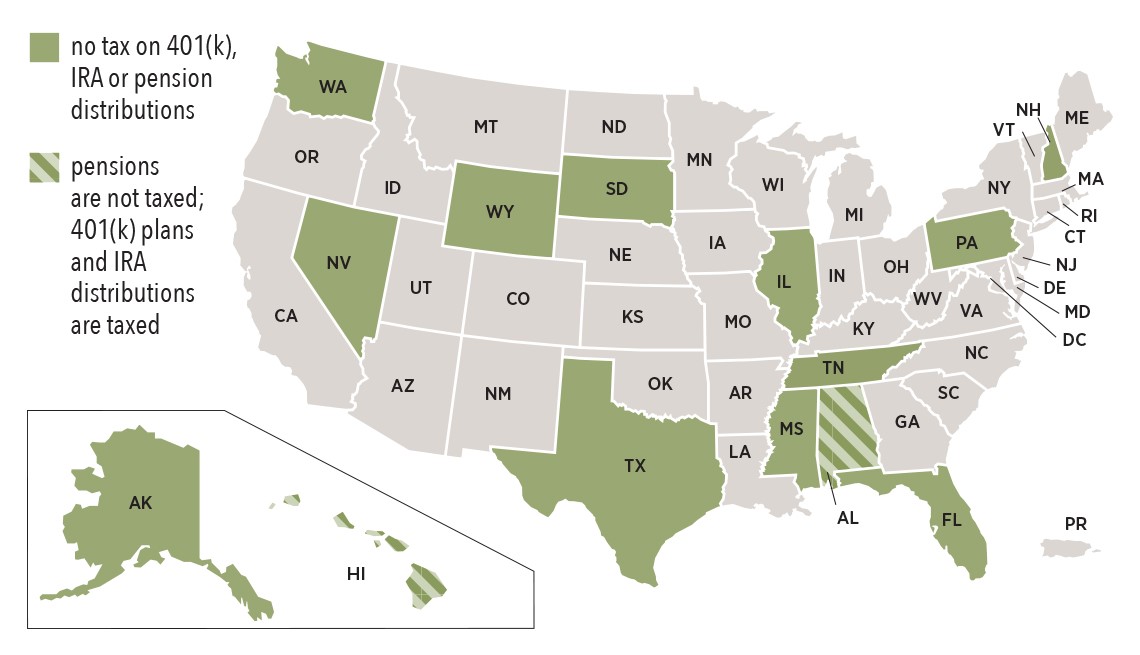

Tax Friendly States That Don T Tax Pensions Or Social Security Sofi

Recipients of an employer.

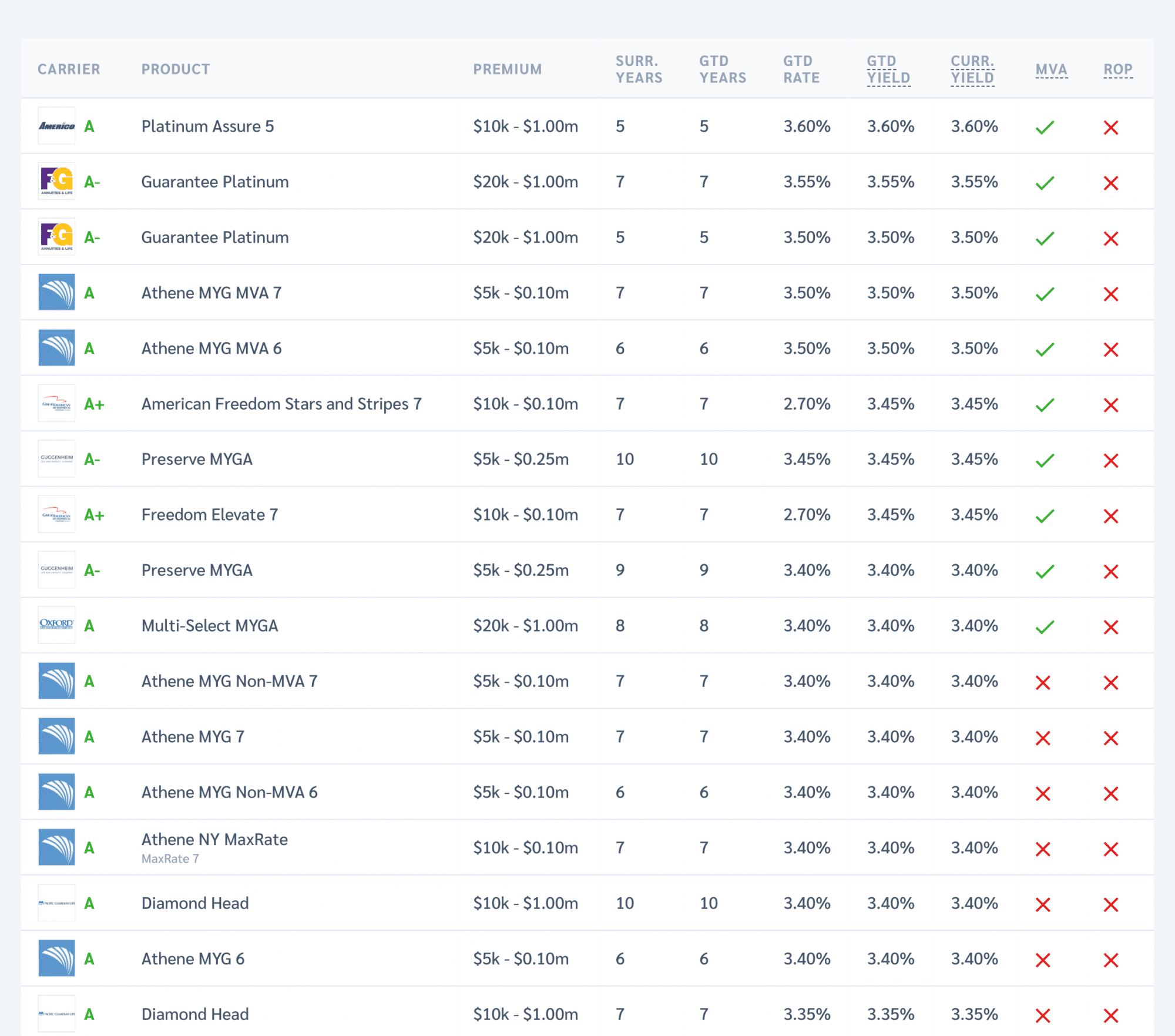

. Web According to the Maine Department of Revenue Military pension benefits including survivor benefits will be completely exempt from the State of Maines income tax. Web But again there are many states 14 to be exact that do not tax pension income at all. Web The state taxes income from retirement accounts and from pensions such as from mainepers.

Keyboard shortcut to check a checkbox in word. Retiree has not paid Federal or. Alaska Florida Nevada South Dakota Tennessee Texas.

Maine allows for a deduction for pension income of up to 10000 that is included in your federal adjusted gross income. Web 51 rows No exclusions exemptions or deductions for out-of-state government pensions. Maine Tax Return Begins with Federal AGI Review the discussion about Differences with.

Web Maine is one of those states. Web June 6 2019 239 AM. The difference is that their exemptions are quite scanty compared with the average.

Web You also need to consider Maine retirement taxes as they apply to pensions and distributions when choosing a place to settle after working for so many years. Deduct up to 10000 of pension and annuity income. Reduced by social security received.

Retiree paid Federal taxes on contributions made before January 1 1989. For 2021 up to 4400 of income from a retirement plan including 401k plans and IRAs is exempt for taxpayers. Web Retiree already paid Maine state taxes on all of their contributions.

Web Montana Tax Breaks for Other Retirement Income. Web 52 rows Maine. Web Is my retirement income taxable to Maine.

MA pensions qualify for the pension exemption. Web You have to pay income tax on your pension and on withdrawals from any tax-deferred investmentssuch as traditional IRAs 401 ks 403 bs and similar retirement. For single filers with an adjusted gross income.

Web Maine does not tax active Military pensions - AT ALL. Maine allows for a deduction of up to 10000 per year on pension income. Web States that dont tax military retirement pay include.

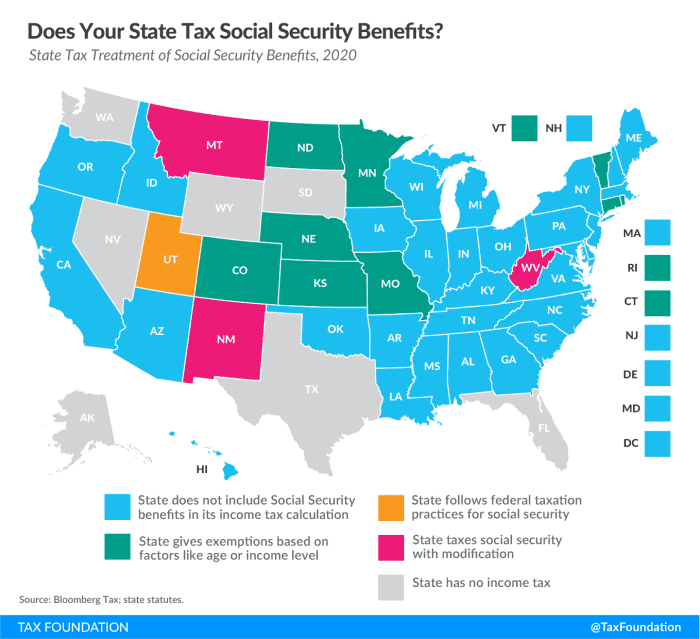

However that deduction is reduced in an amount equal to your annual. Web Social Security is taxable in Montana but there is a deduction available for taxpayers below a certain income level. Web For tax years beginning on or after January 1 2016 the benefits received under a military retirement plan including survivor benefits are fully exempt from Maine income.

However other forms of retirement income are taxable including ira 401k.

Taxes In Retirement How All 50 States Tax Retirees Kiplinger

15 States That Don T Tax Retirement Income Pensions Social Security

12 States That Don T Tax Social Security Or 401 K Ira Retirement Income The Motley Fool

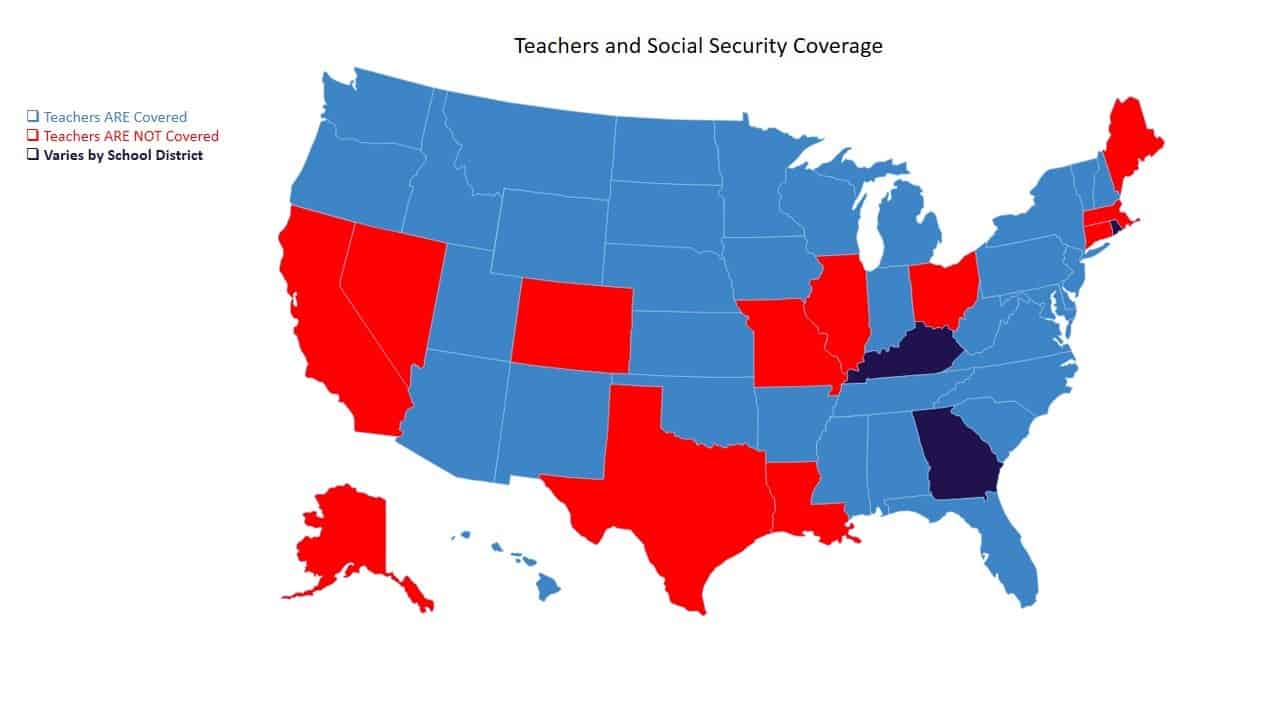

Teacher S Retirement And Social Security Social Security Intelligence

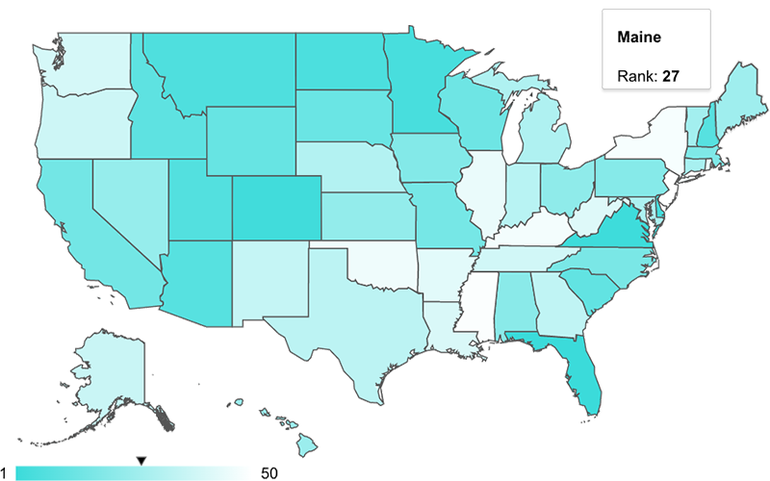

Does Maine Tax Social Security

Maine Among Priciest States To Retire Study Says Mainebiz Biz

Pension Exemptions Benefit Wealthy Households And Compromise Resources Mecep

7 States That Do Not Tax Retirement Income

37 States Don T Tax Your Social Security Benefits Make That 38 In 2022 Marketwatch

How Will Your Retirement Benefits Be Taxed The Motley Fool

Maine Eyes Repealing Income Tax On Public Employees Pensions

15 States That Don T Tax Retirement Income Pensions Social Security

12 States That Keep Retirement Dollars In Your Pocket Alhambra Investments

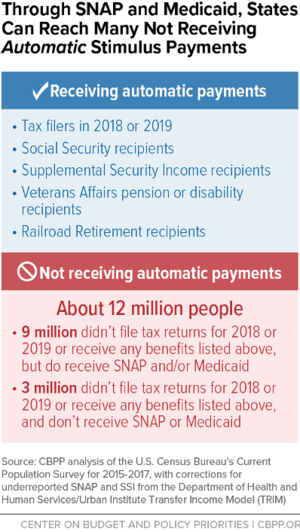

Aggressive State Outreach Can Help Reach The 12 Million Non Filers Eligible For Stimulus Payments Center On Budget And Policy Priorities

Retirement Costs Driving Fiscal Crisis For State S Largest Cities Cbia

Vermont Ranks 18th Best State For Veterans Vermont Business Magazine

Pros And Cons Of Retiring In Maine Cumberland Crossing

Evaluating Where To Retire Pennsylvania Vs Surrounding States Rodgers Associates